i-80 Gold Corp. Closes C$115 Million Bought Deal Public Offering

Reno, Nevada, May 1, 2024 – i-80 Gold Corp. (TSX: IAU) (NYSE American: IAUX) (“i-80“, or the “Company“) is pleased to announce the closing of its previously announced “bought deal” public offering of an aggregate of 69,698,050 units (each, a “Unit“) at a price of C$1.65 per Unit for aggregate gross proceeds to the Company of approximately C$115 million (the “Offering“), including the full exercise of the over-allotment option.

Each Unit consists of one common share in the capital of the Company (each, a “Common Share“) and one-half of one Common Share purchase warrant of the Company (each whole Common Share purchase warrant, a “Warrant“). Each Warrant is exercisable to acquire one Common Share (each, a “Warrant Share“) for a period of 48 months from closing of the Offering at an exercise price of C$2.15 per Warrant Share.

The Offering was led by National Bank Financial Inc. as lead underwriter and sole bookrunner, together with Canaccord Genuity Corp. and Stifel Nicolaus Canada Inc. as co-lead underwriters, and BMO Nesbitt Burns Inc., RBC Dominion Securities Inc., Scotia Capital Inc., Cormark Securities Inc. and PI Financial Corp. (collectively, the “Underwriters“). The Underwriters were paid a cash commission equal to 5% of the gross proceeds of the Offering, excluding proceeds from sales of Units to certain president’s list purchasers.

The Offering was completed pursuant to a short form prospectus dated April 25, 2024 (the “Prospectus“) in all of the provinces of Canada, except the province of Québec, and offered in the United States to “qualified institutional buyers” pursuant to an exemption from registration under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) and in those other jurisdictions outside Canada and the United States pursuant to exemptions from prospectus and registration requirements.

The net proceeds of the Offering will be used to advance the development of the Company’s mineral properties and for general corporate purposes, as more particularly described in the Prospectus.

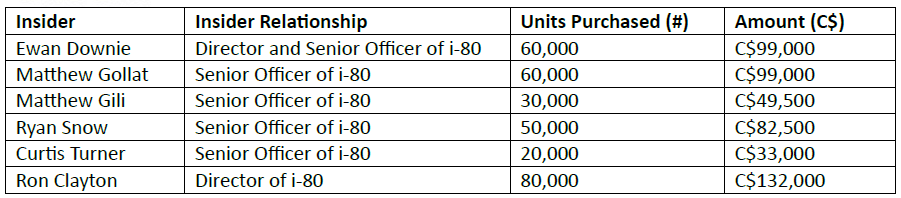

Certain directors and officers of the Company named below (collectively, the “Insiders“) purchased an aggregate of 300,000 Units pursuant to the Offering (the “Insider Participation“). Participation by the Insiders in the Offering was considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The Company was exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the Insiders’ participation in the Offering pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as neither the fair market value of any securities issued to, nor the consideration paid by, the Insiders exceeded 25% of i-80’s market capitalization. The Company did not file a material change report relating to the Insider Participation more than 21 days before the expected closing date of the Offering as the details of the Insider Participation was not settled at such time.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities have not been and will not be registered under the U.S. Securities Act or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws unless an exemption from such registration is available.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company’s advanced-stage property portfolio with processing at i-80’s centralized milling facilities. i-80 Gold Corp.’s common shares are listed on the TSX and the NYSE American under the trading symbol IAU:TSX and IAUX:NYSE American. Further information about i-80 Gold Corp.’s portfolio of assets and long-term growth strategy is available at www.i80gold.com or by email at info@i80gold.com.

For further information, please contact:

Ewan Downie – CEO

Matt Gili – President & COO

Matthew Gollat – EVP Business & Corporate Development

1.866.525.6450

Info@i80gold.com

www.i80gold.com

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including but not limited to, the use of proceeds in connection with the Company’s material properties. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the Company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.